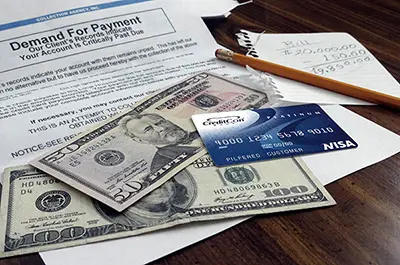

No matter what kind of debt you have; mortgage debt, car payments, credit card debt, student loans or any other type of payment obligation, it’s never something you look forward to paying every month. And unfortunately, if you fail to pay your debt, you just may find your wages garnished.

The term wage garnishment means that part of your paycheck will be seized by court order for the payment of your debt. If this happens to you, your employer will be notified, and by law, withhold part of your wages to pay off your debt. Under Title III of the Consumer Credit Protection Act, the garnishment withheld from your paycheck can’t be excessive.

For the most part, a garnishment is levied against all of your earnings. This means, that it’s not just your after-tax salary that can be seized, but your commissions, bonuses, pension or retirement plan can be seized if you do not stop wage garnishment before it starts.

Wage garnishment is used to pay any number of debts; such as unpaid local, state and federal taxes, unpaid child support, student loans and private creditors. By law, most creditors must go to court in order to garnish your earnings, but some government obligations (i.e.: money owed to the IRS), don’t require a court order.

If your earnings are garnished to pay your debts, that garnishment is considered received by you for federal income tax purposes. That being said, the amount garnished is income and will be reportable as wages on your federal tax income return. The bottom line is that even though this money never made it into your bank account, wage garnishment is 100% taxable. This is just another reason to stop wage garnishment from happening.

If you find yourself in a position where you can’t pay your tax debt, and need to stop wage garnishment, the best way to overcome this is to work with an honest and well trained tax resolution professional to settle your IRS debt on your behalf. At Wasvary Tax, you will have the resources available to resolve your tax debt on a budget.