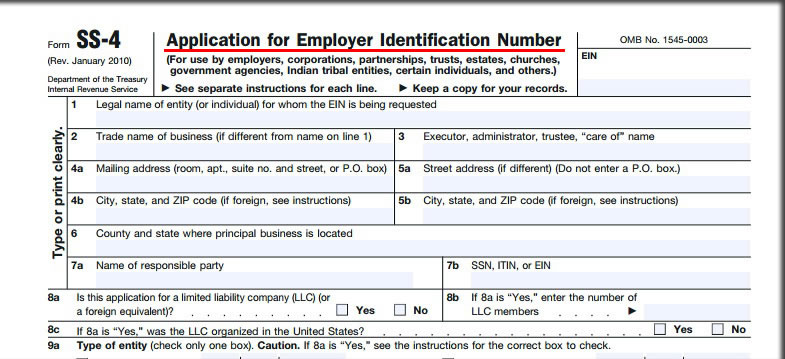

EIN identifies your business

A Federal Tax ID Number or Employer Identification Number (EIN), is basically a Social Security Number for a business. The IRS uses it to identify a business, and it must be included on all your business tax filings. Also, banks typically require an EIN in order to open a business bank account. Other companies that you do business with may also require that your business provide an EIN number in order to pay any of your invoices.

If you currently operate your business as a sole proprietorship or general partnership and want to incorporate or form an LLC, you must obtain a new Federal Tax ID Number (EIN) for your business.

At Wasvary Tax Services we have multiple years of experience with helping our clients get their EIN for their business. Our expertise can help guide you in what can often seem like a totally overwhelming, perhaps even impossible, process.

Receive a FREE Consultation by filling out our online form or calling (818) 705-2822