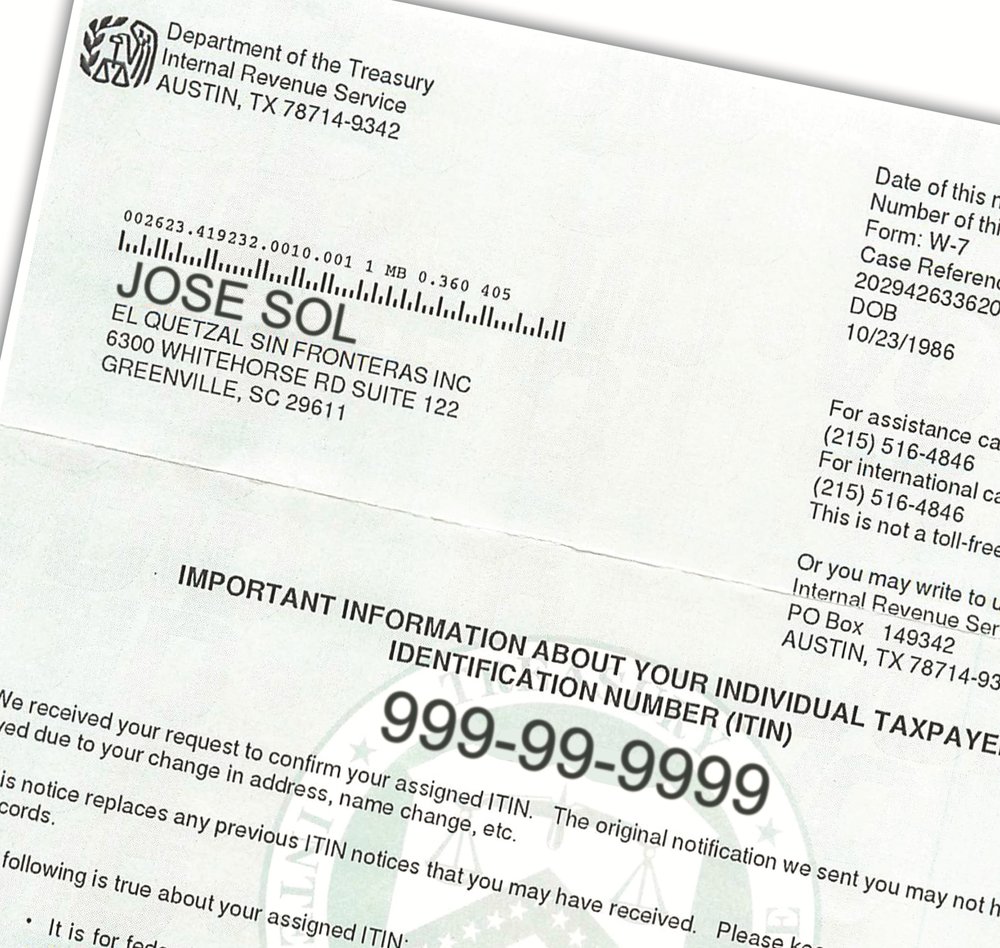

ITIN or an Individual Taxpayer Identification Number is a tax processing number issued by the Internal Revenue Service (IRS), income tax department of the US. ITIN is a nine digit number and always begins with the number 9 and has a 7 or 8 in the fourth digit, such as 9XX-7X-XXXX.

IRS issues ITIN only to those individuals who are required to have a US taxpayer identification number but do not have and are ineligible to obtain, a Social Security Number (SSN) from the Social Security Administration (SSA). ITINs allows individuals to comply with the US tax laws and provides a means to efficiently process and account for tax returns and payments for those not eligible for Social Security Numbers.

Need and Eligibility for ITIN

If you do not have an SSN and are not eligible to obtain an SSN, but you have a requirement to furnish a federal tax identification number or file a federal income tax return, you must apply for an ITIN. By law, an alien individual cannot have both an ITIN and an SSN.

ITINs are issued regardless of immigration status because both resident and nonresident aliens may have U.S. tax return and payment responsibilities under the Internal Revenue Code.

In order to be eligible for ITIN, you must fall into one of the following categories:

- Non-resident alien who is required to file a US tax return

- US resident alien who is (based on days present in the US) filing a US tax return

- Dependent or spouse of a US citizen/resident alien.

- Dependent or spouse of a nonresident alien visa holder such as H4 visa holder.

- Nonresident alien claiming a tax treaty benefit

- Nonresident alien student, professor or researcher filing a US tax return or claiming an exception.

Limitations of ITIN

ITINs are used for federal income tax purposes only. It is not intended to serve any other purpose. It has several limitations or restrictions:

- Individuals must have a filing requirement and file a valid federal income tax return to receive an ITIN, unless they meet an exception, as described in Form W-7 Instructions.

- ITIN does not authorize work in the U.S.

- ITIN does not provide eligibility for Social Security benefits or the Earned Income Tax Credit.

- ITINs are not valid identification outside the tax system. Since ITINs are strictly for tax processing, the IRS does not apply the same standards as agencies that provide genuine identity certification. ITIN applicants are not required to apply in person, and the IRS does not further validate the authenticity of identity documents. ITINs do not prove identity outside the tax system, and should not be offered or accepted as identification for non-tax purposes.

However, ITIN filers can claim the Child Tax Credit and Additional Child Tax Credit, as appropriate.

source: irs.gov